The release of Walmart+ last month has given US consumers plenty to think about. In fact, it’s extra-ordinary that Walmart+ is seen as a key competitor to Amazon Prime a full fifteen years after the Amazon concept was launched, and even despite the existence of a previous Walmart program known as “Delivery Unlimited”.

While “delivery unlimited” ONLY offered free unlimited delivery, Walmart+ promises “lots of other benefits”, so our professional curiosity was of course piqued. In this article, we are sharing our views on this latest industry launch.

Walmart+ launched September 2020 – fifteen years after Amazon Prime

Walmart+ launched September 2020 – fifteen years after Amazon Prime

US Online Grocery Giants Compete

At first glance, Amazon Prime and Walmart+ offer incredibly similar benefits, yet as usual, the devil is in the detail. The table below illustrates just how similar the two brands are in terms of their online grocery services. At a slightly cheaper annual fee, Walmart+ appears cheaper, however the minimum spend requirement may mean it’s not always as useful for customers as the Prime option.

From a purely grocery perspective, with almost 5,000 Walmart stores across the country, Walmart are calling their new program “the ultimate life hack” and suggesting that the sheer scale of their retail footprint combined with this option for unlimited deliveries offers “unprecedented value”, claiming to save customers “time and money like no other retailer can.” It’s certainly a big statement given the fifteen year time lag mentioned earlier.

Comparison Table Courtesy of USA Today

Comparison Table Courtesy of USA Today

For us, the $21 price difference is probably the least important criteria to choose between the two giants, particularly as the core proposition of Walmart+ is simply a re-brand of “delivery unlimited”. Many of the US’s top media such as USA Today have discussed the two current grocery options in great detail, comparing delivery times, brand availability and value of money, so we will focus on the other key factors that may tip the scales in Walmart’s favour. We have previously discussed Amazon’s key selling points in our article – Prime’s Proven Power, with Jeff Bezos describing it as “so good, customers would be irresponsible not to join”.

USP #1:

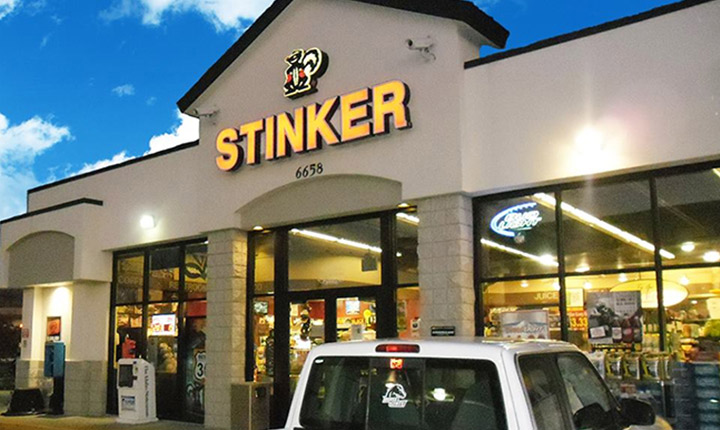

With so much focus on driving savings on grocery spend, it seems hard to predict whether Amazon or Walmart can consistently offer the most savings on grocery purchases alone. Therefore, the first selling point that Walmart+ can claim as a unique benefit for their members is the added savings on gas. Walmart+ members save up to 5 cents a gallon at nearly 2,000 Walmart, Murphy USA and Murphy Express fuel stations, similar to loyalty subscription propositions we’ve written about from both Racetrac Rewards and 7Eleven stores in certain states. It seems unlikely (but certainly not impossible) that Amazon Prime will choose to compete with this service offering any time soon. Therefore, for consumers who drive a lot and are keen to save on fuel, Walmart+ will win out.

USP #2:

It’s impossible to predict when (or if) consumers will shop in supermarkets in the same numbers as before, when they do, the “Scan & Go” option for Walmart+ members will undoubtedly prove to be a faster way to shop. As you can see in the video below, using the app, customers scan their items as they add them to their basket, keep a track of their spend in real time and then pay on their phone using Walmart Pay for a quick, easy and contactless check-out experience.

Bringing digital benefits to physical stores – Walmart+ includes “scan and go” functionality for members.

Is Two Too Many?

As a non US resident, many thousands of miles away from the market these two giants compete in, my conclusion is I would enjoy the benefits of both options at different times. My fuel savings would need to be carefully estimated, but alongside the likelihood I would be shopping in their stores too, I would expect to buy enough from Walmart to justify investing in their Plus membership.

Similarly, Amazon Prime is consistently compelling. Beyond any grocery shopping, the Prime fee is justifiable given the sheer volume of products I buy from them year round – from books to electronics, as well as the extensive Prime Video entertainment library.

Membership Messaging

A final difference is noteworthy between the approach that Walmart is taking compared to Amazon’s transactional & functional approach.

With the loyalty industry highlighting the increasing importance of driving emotional loyalty, it’s great to see Walmart leading its communications strategy for Walmart+ around the idea that we are all first and foremost members of families and communities, and that membership of a program like Plus allows us enjoy those connections even more.

Very nice positioning Walmart! We’ll watch the growth of Walmart+ with great interest.

Walmart+ is positioning its program membership as a way to save time for family and other priorities.

![]()

About Us:

Liquid Barcodes is a leading global loyalty and digital marketing technology company specialising in the convenience store and foodservice industries. Our proprietary cloud-based technology platform allow retailers to create and manage their digital marketing campaigns with a proprietary process we call the “customer connection cycle’ to engage, promote and reward customers activities in real-time across digital and media channels.

How we do it:

We have developed the most advanced loyalty and digital marketing technology platform specifically for convenience store and foodservice retailers globally.

Retailers use our self-service dashboard to create and manage loyalty driven marketing campaigns that increase purchases with their existing customers, as well as effectively target and acquire new customers through partners or paid media channels.

One core component of live loyalty is gamification. We have gamified branding, loyalty and promotions. We believe this approach is essential in order to get customers’ attention and ultimately truly engage them with repeatable actions thereby winning their loyalty.

Check out some of our exciting/proven results here:

About Me:

Chief Content Officer, Liquid Barcodes and Independent Loyalty Consultant

With over twenty-five years marketing experience, I specialise in loyalty marketing consulting, managing consumer loyalty propositions, strategy and operations. In addition to working with Liquid Barcodes, my clients have included Telefonica O2 Priority, Three Mobile, Electric Ireland, Allied Irish Bank and The Entertainer Group (UAE), as well as Avios – the global points currency for some of the world’s top airlines. I am also a former judge for the Loyalty Magazine Awards and host of the “Let’s Talk Loyalty” podcast.

—————————————————————————————–